Cost of living survey

Help us improve the cost of living support in Barking and Dagenham by taking part in our survey. Your feedback is invaluable in enhancing the support we offer!

Your Council Tax pays for:

Councillors have agreed the 2025/26 budget at a full council meeting on Wednesday 26 February 2025. You can read more in our news story.

This year we’ve had to take the tough decision to increase Council Tax by 2.99%, with a further 2% increase to be ring-fenced to pay for adult social care. That’s an increase of around £1.47 for the week on a Band D property and will help us to provide essential services for our community.

Council Tax information (PDF, 2.7 MB)

For information and advice, please visit our Struggling to pay your Council Tax page.

| Budget 2024/25 | £221,745,000 |

|---|---|

| Service Pressures & Improvements | £33,077,000 |

| Savings | -£16,119,000 |

| Budget 2025/26 | £238,703,000 |

| Service | 24/25 | 25/26 |

|---|---|---|

| People & Resilience | £139,665,000 | £142,246,000 |

| Resources | £26,898,000 | £24,598,000 |

| Workforce Change | £2,553,000 | £2,396,000 |

| Strategy | £6,110,000 | £5,706,000 |

| Inclusive Growth | £1,021,000 | £1,334,000 |

| Housing, Environment and Communities | £16,292,000 | £13,267,000 |

| Corporate Items | £29,207,000 | £49,156,000 |

| Total Net Expenditure | £221,746,000 | £238,703,000 |

| Gross Expenditure | £647,151,000 | £566,555,000 |

| Gross Income | £425,406,000 | £327,852,000 |

| Total Funding Required | £221,746,000 | £238,703,000 |

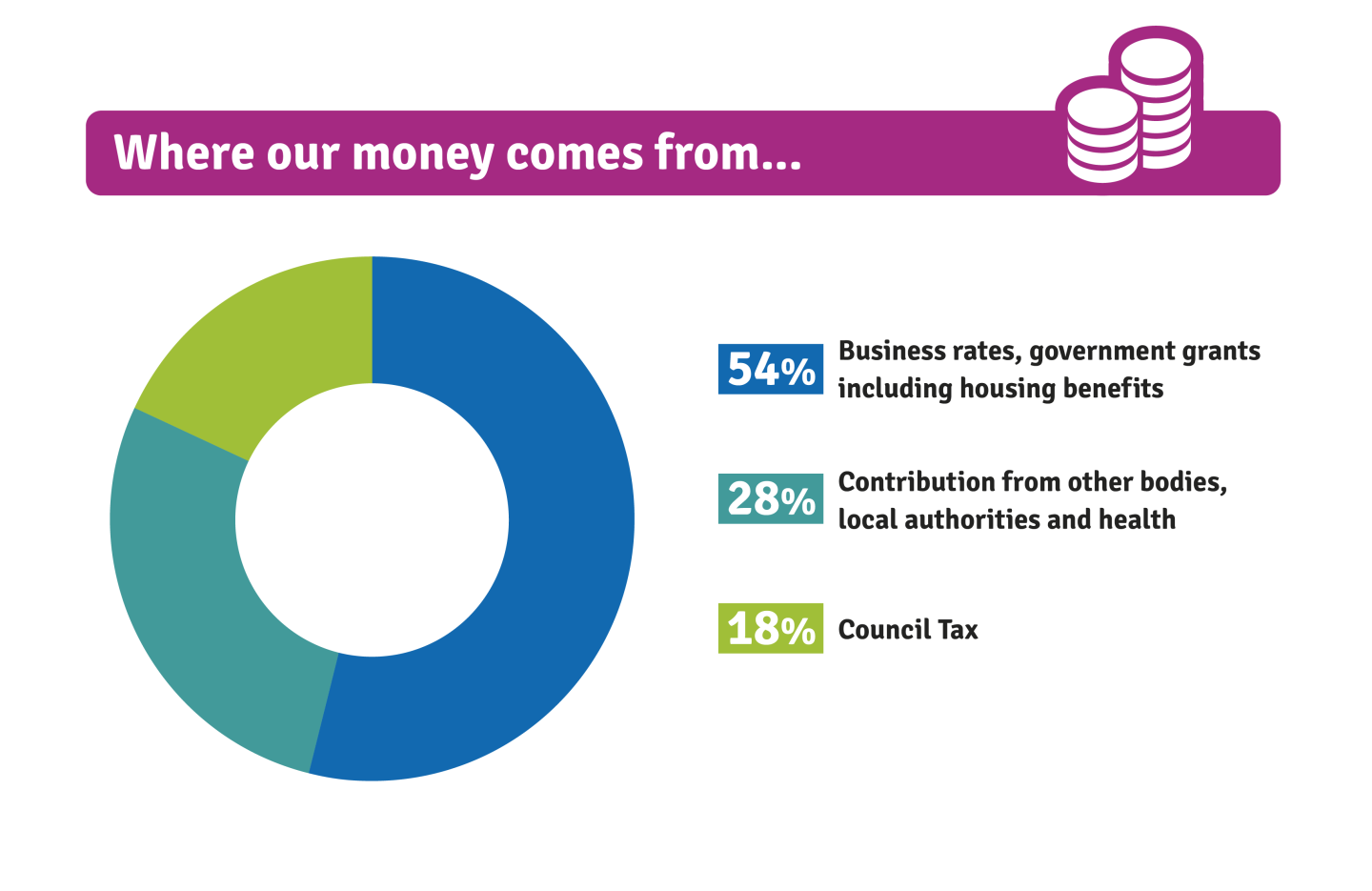

| Business Rates | £78,357,000 | £79,786,000 |

| Government Grants (Inc. Housing Benefit) | £50,483,000 | £65,430,000 |

| Other Funding Sources | £8,809,000 | £0 |

| Council Tax | £84,096,000 | £93,486,000 |

| Number of Houses at Band D Equivalent | 54,917 | 58,147 |

| Band D Council Tax | £1,531 | £1,608 |

| Band D GLA Precept | £471 | £490 |

| Total Band D Council Tax Bill | £2,003 | £2,098 |

| Band D Council Tax | 2024/25 | 2025/26 | Change |

|---|---|---|---|

| London Borough of Barking & Dagenham | £1,531.35 | £1,607.76 | 4.99% |

| Greater London Authority | £471.40 | £490.38 | 4.0% |

| Total | £2,002.75 | £2,098.14 | 4.8% |

The Secretary of State made an offer to adult social care authorities. (“Adult social care authorities” are local authorities which have functions under Part 1 of the Care Act 2014, namely county councils in England, district councils for an area in England for which there is no county council, London borough councils, the Common Council of the City of London and the Council of the Isles of Scilly.)

The offer was the option of an adult social care authority being able to charge an additional “precept” on its council tax without holding a referendum, to assist the authority in meeting its expenditure on adult social care from the financial year 2016-17.

It was originally made in respect of the financial years up to and including 2019-20, however has since been extended. If the Secretary of State chooses to renew this offer in respect of a particular financial year, this is subject to the approval of the House of Commons.

This financial year 2025/26, the Secretary of State has allowed adult social care authorities to charge a precept of up to 2% in addition to the normal council tax increase of 2.99%.

The income generated from this charge is ring-fenced, meaning it can only be used for adult social care services which support some of the most vulnerable members of our community, such as the elderly and adults with disabilities.

You can find information on the Greater London Authority (GLA) charge on Council Tax including how much it is and what it is used for in Your council tax and the GLA (PDF, 111.13 KB).

ELWA has the statutory responsibility for the disposal of household and commercial waste collected by the London Boroughs of Barking & Dagenham, Havering, Newham and Redbridge, and for the provision of Reuse and Recycling Centres in its area.

Waste disposal is carried out under a 25-year Integrated Waste Management Services Contract by Biffa (formerly Renewi plc). ELWA receives funding support via the government’s Private Finance Initiative.

ELWA’s total levy requirement is £76,844,000 (2024/25: £75,740,000). The 2025/26 budget includes an inflationary increase in contract and operational costs as well as provision for increases in waste tonnages. This is offset by use of the packaging extended producer responsibility funding and release of prior years’ budget surplus. Further information can be found on the ELWA website. The increase for the London Borough of Barking & Dagenham is 1.48%.

The major part of the ELWA Levy is apportioned on the basis of relative amounts of household waste delivered to ELWA by each of the four constituent London Boroughs, with the remainder apportioned according to their Council Tax Bases.

The Levy on the London Borough of Barking & Dagenham for 2025/26 is £14,448,000 (2024/25: £14,238,000).

Lee Valley Regional Park is a unique leisure, sports and environmental destination for all residents of London, Essex and Hertfordshire. The 26 mile long, 10,000 acre Park, much of it formerly derelict land, is partly funded by a levy on the council tax. This year there has been a 2.7% increase in this levy.

Find out more about hundreds of great days out, world class sports venues and award winning parklands on the Lee Valley Regional Park Authority website.

Budget/Levy 2025/26 (£'million)

| 2024/25 | 2025/26 | |

|---|---|---|

| £m | £m | |

| Authority Operating Expenditure | 15.3 | 15.6 |

| Authority Operating Income | (7.8) | (8.0) |

| Net Service Operating Costs | 7.5 | 7.6 |

| Financing Costs - Debt servicing/repayments | 2.2 | 2.1 |

| Financing Costs - Capital investment | 1.3 | 1.6 |

| Total Net Expenditure | 11.0 | 11.3 |

| Net use of Reserves | (0.0) | (0.0) |

| Total Levy | (11.0) | (11.3) |

Further details on how this budget is spent and the amount each council contributes can be found on the Lee Valley Regional Park Authority website.

The London Pensions Fund Authority (LPFA) raises a levy each year to meet expenditure on premature retirement compensation and outstanding personnel matters for which LPFA is responsible and cannot charge to the pension fund. These payments relate to former employees of the Greater London Council (GLC), the Inner London Education Authority (ILEA) and the London Residuary Body (LRB).

For 2025/26, the income to be raised by levies is set out below. The Greater London levy is payable in all boroughs, the Inner London levy only in Inner London Boroughs (including the City of London). The figures show the total to be raised.

| Inner London | £7,000,000 |

| Greater London | £1,000,000 |

| Total | £8,000,000 |

From 2022 onwards, a portion of the amount previously raised as levies is being paid into the LPFA Pension Fund to address a funding deficit in respect of former GLC, ILEA, and LRB employees.

As part of the 31 March 2025 triennial valuation, the Levy requirements will be reviewed and communicated to all the London Boroughs as part of the 2026/27 levy setting process.

The Environment Agency is a levying body for its Flood and Coastal Erosion Risk Management Functions under the Flood and Water Management Act 2010 and the Environment Agency (Levies) (England and Wales) Regulations 2011.

The Environment Agency has powers in respect of flood and coastal erosion risk management for 5200 kilometres of main river and along tidal and sea defences in the area of the Thames Regional Flood and Coastal Committee. Money is spent on the construction of new flood defence schemes, the maintenance of the river system and existing flood defences together with the operation of a flood warning system and management of the risk of coastal erosion. The financial details are:

Thames Regional Flood and Coastal Committee

|

2024/25 '000s |

2025/26 '000s |

|

|---|---|---|

| Gross Expenditure | £154,702 | £126,785 |

| Levies Raised | £12,776 | £13,030 |

| Total Council Tax Base | 5,365 | 5,453 |

The majority of funding for flood defence comes directly from the Department for the Environment, Food and Rural Affairs (Defra). However, under the new Partnership Funding rule not all schemes will attract full central funding.To provide local funding for local priorities and contributions for partnership funding the Regional Flood and Coastal Committees recommend through the Environment Agency a local levy.

A change in the gross budgeted expenditure between years reflects the programme of works for both capital and revenue needed by the Regional Flood and Coastal Committee to which you contribute. The total Local Levy raised by this committee has increased by 1.99%.

The total Local Levy raised has increased from £12,775,615 in 2024/2025 to £13,029,850 for 2025/2026.